Frauds against military consumers can undermine military readiness and troop morale. The July observance is meant to increase awareness of consumer control measures (protections) and financial readiness for service members, veterans and military families.Īccording to the FTC, certain scams are more likely to target the military community, in part, because it’s a population that relocates frequently and has many service members who are living on their own and earning a paycheck for the first time. To help people within the military community identify risks while they execute their personal finance plans, the Federal Trade Commission created Military Consumer Month. “If I can get them to start with the basics of an emergency fund, that would be a great place,” she said. People often do not know what they need until there is an emergency, Butler pointed out. Themselves first with the military allotment and have that money in an emergency fund coming directly out of their paycheck into their savings account.” “So, if the service member decides ‘I want to start an emergency fund,’ one of the ways they can do it successfully is to pay “I also direct people to, which is another good website because it offers tips on things as simple as setting up an allotment,” Butler said. The goal is to foster a financially secure and mission-ready force. The DOD Office of Financial Readiness website – – provides support with a variety of resources created specifically for the military community. The Office of Financial Readiness is our ‘go-to’ because it has so much basic literacy training information.” They can always go there and research whatever they need whatever applies to them at the time. “Even if our patrons don’t absorb everything we’re giving them at the time of a class or counseling session, they still have access to the online resources that we provide them. It’s “all about information,” Butler emphasized. Many tools and resources also are provided online.

military community through classroom training, individual counseling sessions and collaborative planning with non-profit organizations like Army Emergency Relief. Instead, the FRP achieves its objective of increasing financial literacy within the U.S. They’re not in the business of setting up stock investment strategies or individual retirement accounts. It would be a misfire to compare FRP specialists to off-post financial advisors. “My job is to teach as much as I can and to reach as many as I can as a financial counselor.” “The Financial Readiness Program is about financial education and financial literacy,” Butler said. Locked and loaded at every installation, FRP specialists like her are the battle captains with the ability to lay out strategies for eliminating debt, balancing budgets, understanding the pitfalls of credit, achieving forward movement with a saving and investing plan, and more. “I give them the order to be financially successful going forward,” said Wanda Butler, a personal financial readiness specialist for Fort Lee’s FRP, as she described the initial guidance she provides to customers. and elsewhere, many among the military community, including reservists and veterans, are struggling to make financial ends meet and are in need of a good battle plan to beat their budget foes.Īnyone in such a predicament would do well to employ the Department of Defense weapon system at their disposal – namely the Financial Readiness Program, or FRP, which is part of the Army Community Service troop and family support network. (Photo Credit: Chad Menegay) VIEW ORIGINALįORT LEE, Va. Army Photo by Chad Menegay, Fort Lee Public Affairs) The event was designed to provide educational opportunities to Fort Lee single service members, Advanced Individual Training students and permanent party Soldiers.

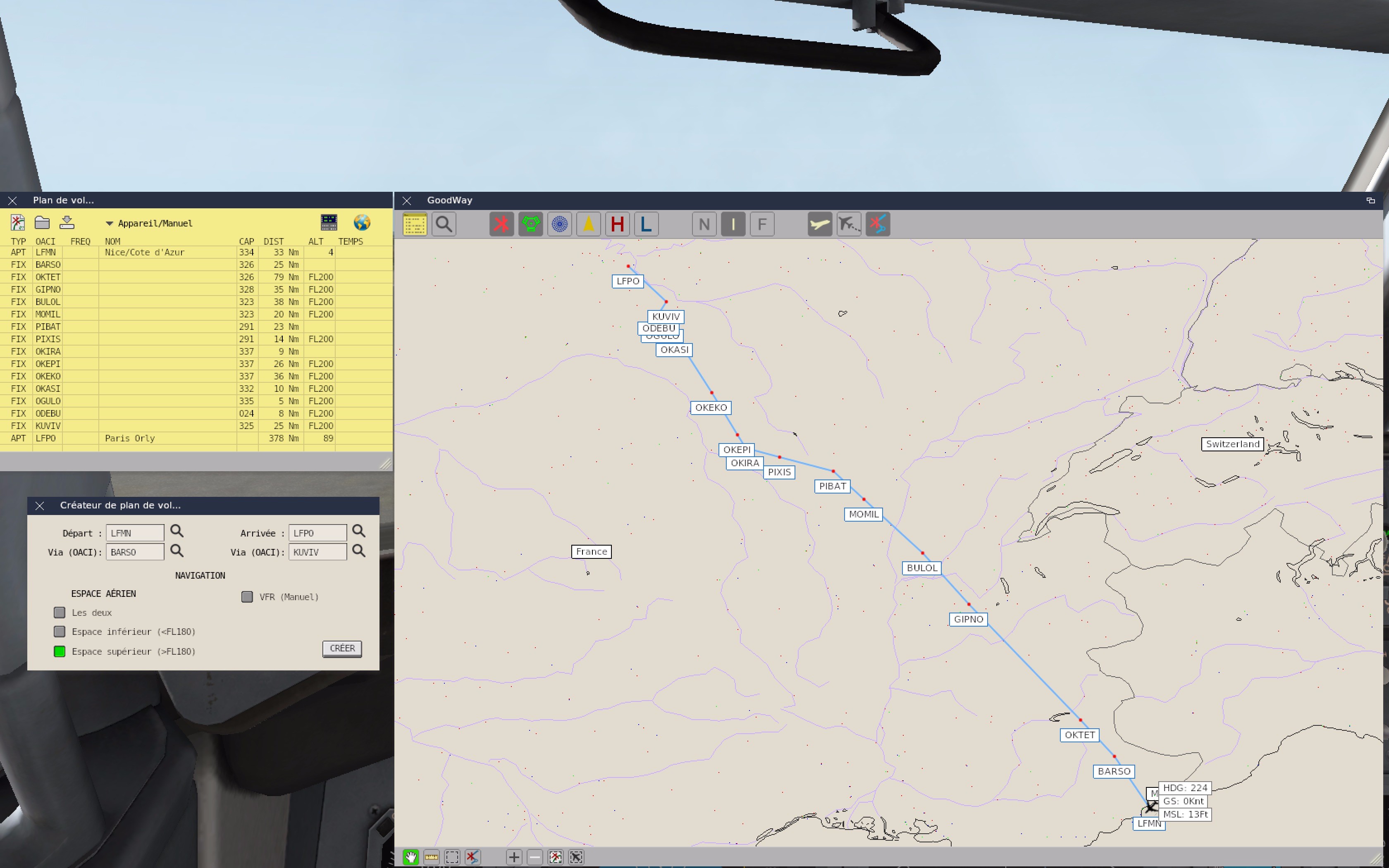

#Youtube mission planner for mac mac

(Photo Credit: Courtesy) VIEW ORIGINAL 2 / 2 Show Caption + Hide Caption –īob Trull (center), a contracted Personal Financial Counselor, talks to Fort Lee Soldiers about managing personal finances as part of a Better Opportunities for Single Soldiers event July 16, 2022, at the Mac Fitness Center in Fort Lee, Va. While servicemembers, veterans, and their families do so much for our country, scammers continue to target their hard-earned salaries and benefits year-round. Each year, to strengthen the economic security of the force, Military Consumer Month provides increased awareness and educational resources to encourage service members to protect their financial futures.

0 kommentar(er)

0 kommentar(er)